How precious metals are taxed

The energy crisis and global economic uncertainty has boosted the purchase of precious metals such as gold and silver. The tax season starts on 6 April, so it is a good time to remember how precious metals are treated for tax purposes.

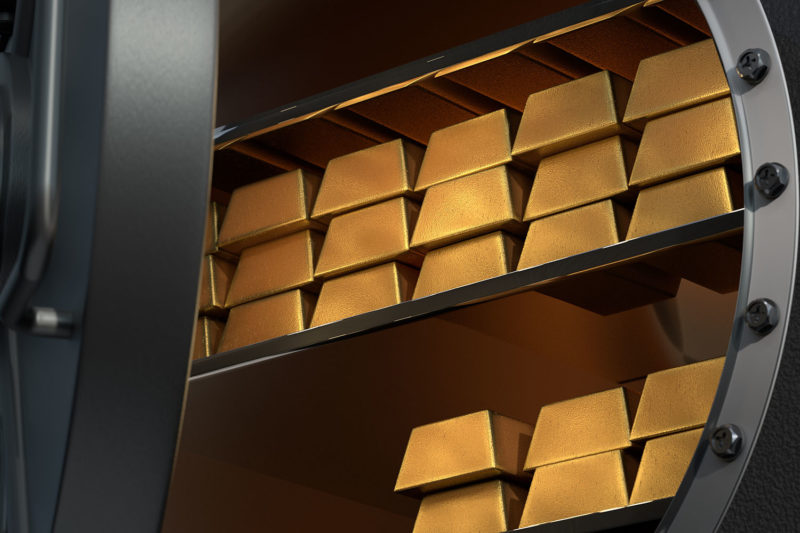

The central banks of several countries are increasing their gold reserves exponentially, but there has also been an increase in demand for this safe-haven asset from people who want to protect their savings in the face of an inflationary economic scenario that has no end in sight. Even so, more and more investors are including precious metals in their portfolios in order to diversify their returns.

However, before investing in gold or any other precious metal, it is important to consider what taxes are payable when buying or selling these highly valued commodities in times of crisis. Taxation can vary depending on whether you are buying physical gold or digital gold, the purity level of the metal, and other factors to consider when assessing the potential returns on your investments.

Investment gold bullion and gold coins

Firstly, we need to be clear that we are not talking about ordinary precious metals, such as those in jewellery or industrial sectors, but about precious metals of investment value. This distinction is important because according to the European Union decree 77/388/EEC, investment gold does not pay VAT either on purchase or sale.

The Tax Agency defines this special scheme for investment gold as “a compulsory scheme, without prejudice to the possibility of waiver for each transaction, applicable to transactions involving investment gold where such transactions are generally exempt from VAT, with partial limitation of the right to deduct”. In other words, the current VAT Law establishes certain requirements for it to be considered investment gold.

Therefore, investment gold will be exempt from paying VAT as long as it is physical gold, that is, gold bars or coins, such as the gold we offer through Preciosos 11Onze. In addition, this gold must meet minimum purity requirements: 99.5% in the case of bullion, and 80% in the case of coins. Bullion and coins that do not reach this purity will have to pay VAT at 21%, the same rate that applies to the purchase of other precious metals.

Income tax

Silver and other precious metals pay VAT like any other product, and each country applies its own tax rate, 21% in the case of Spain. Therefore, as investors, we have to bear in mind that these are different investments from gold, and often more speculative.

In terms of personal income tax (IRPF), any sale of gold, or any other precious metal by the taxpayer, has to be included in the tax return, and will be taxed according to the capital gains or losses generated by the operation, by the taxable savings base.

In this way, if a capital gain has been achieved with the operation, it will be necessary to reflect it taking into account the purchase price, including expenses, and the sale price, excluding expenses, with applicable rates depending on the amount.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

👏

Gràcies, Daniela!!!

Gràcies per la informació

Moltes gràcies a tu per ser-hi, Jordi!!!

Interessant i necessària informació, gràcies.

Celebrem que t’hagi agradat. Moltes gràcies pel teu comentari!!!

👍

Gràcies, Manel!!!

Queda clar com tributa l’or d’inversió.

Doncs sí, queda molt clar. Moltes gràcies pel teu comentari, Francesc!!!

👌

🙏

Ostras gràcies per aquesta informació ,m’ha semblat curiós que no s’aplica IVA amb la compra o venda de l’or d’inversio

Així és, Alícia. Des de La Plaça intentem informar i aprendre moltes coses que de segur ens són útils en el nostre dia a dia. Gràcies per ser-hi sempre!😉