De-dollarisation boosts gold purchases

Central banks buy record amounts of gold while drastically reducing their dollar reserves. The banking crisis, market volatility and geopolitical tension are shaking the global monetary system and threatening the dollar’s hegemony.

It is no secret that the rising value of gold is fuelled by bad news and economic uncertainty. The risk of contagion from the US banking crisis and market volatility in the face of a possible recession have caused the price of this precious metal to rise by 10% since January.

So far nothing new, the demand and price of gold are approaching historic highs whenever money seeks refuge in safe-haven assets such as precious metals. According to a report by the World Gold Council (WGC), central banks have maintained a steady pace of gold purchases during the first quarter of 2023, adding almost 230 tonnes of gold to their national reserves, an increase of 176% over purchases made in the same period last year.

In this case, however, the gold rush is partly due to an occurrence that could signify a paradigm shift in the world order. We are talking about de-dollarisation, a process that implies a reduction in dependence on the dollar as a currency for international trade transactions and as a reserve currency. The consensus among geopolitical and economic analysts is that the end of the dollar’s reign as an international reserve currency is not a question of if, but of when it will happen.

Growing demand for tangible assets

It would be unfair to attribute the rise in gold purchases to a single factor, but there is no denying that a return to fiat currencies underpinned by tangible assets such as precious metals is the order of the day. From digital currencies issued by some central banks to a future quantum financial system, gold is establishing itself as the ultimate safe-haven asset and an antidote to the loss of confidence in today’s fiat currencies.

According to the IMF, the US dollar’s market share as the world’s reserve currency has fallen from 66% in 2003 to 58.4% at the end of the fourth quarter of this year. A downward trend that is accelerating thanks to economic sanctions and which contrasts with an exponential increase in central banks’ gold reserves.

In this context, and unlike other occasions, it is important to bear in mind that this increase in demand for gold is not only driven by small and large investors who want to protect themselves against inflation and falling interest rates but is also led by central banks, which now account for 33% of the global market.

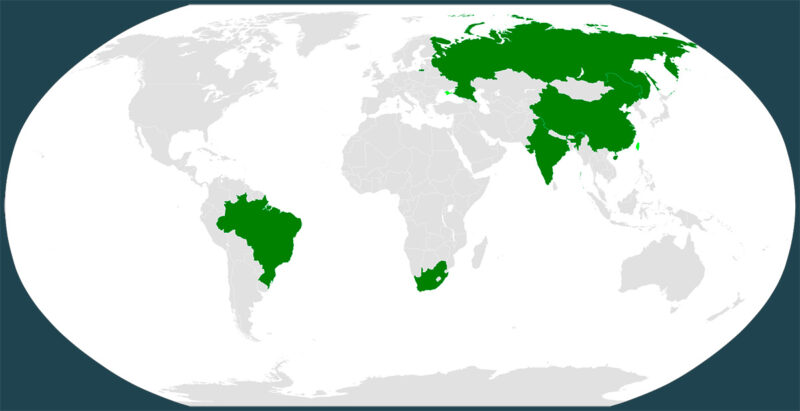

This diversification into gold, especially spurred by large emerging economies that are part of the BRICS group, seems to confirm that the international financial system is undergoing a radical transformation process which, although it is too early to know whether it will mean a return to the gold standard, suggests a continued demand for this precious metal and other tangible assets.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Leave a Reply

You must be logged in to post a comment.

👍

Gràcies, Manel!!!

Gràcies!

Gràcies a tu, Joan!!!