How precious metals are taxed

The energy crisis and global economic uncertainty has boosted the purchase of precious metals such as gold and silver. The tax season starts on 6 April, so it is a good time to remember how precious metals are treated for tax purposes.

The central banks of several countries are increasing their gold reserves exponentially, but there has also been an increase in demand for this safe-haven asset from people who want to protect their savings in the face of an inflationary economic scenario that has no end in sight. Even so, more and more investors are including precious metals in their portfolios in order to diversify their returns.

However, before investing in gold or any other precious metal, it is important to consider what taxes are payable when buying or selling these highly valued commodities in times of crisis. Taxation can vary depending on whether you are buying physical gold or digital gold, the purity level of the metal, and other factors to consider when assessing the potential returns on your investments.

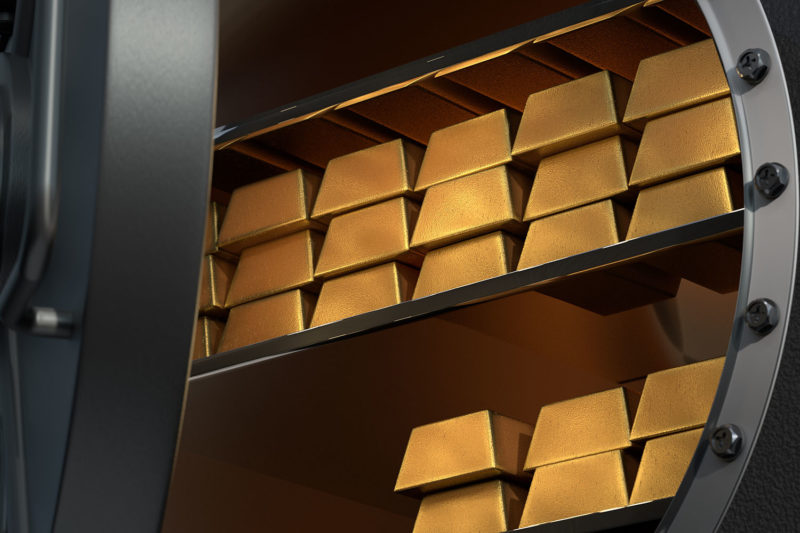

Investment gold bullion and gold coins

Firstly, we need to be clear that we are not talking about ordinary precious metals, such as those in jewellery or industrial sectors, but about precious metals of investment value. This distinction is important because according to the European Union decree 77/388/EEC, investment gold does not pay VAT either on purchase or sale.

The Tax Agency defines this special scheme for investment gold as “a compulsory scheme, without prejudice to the possibility of waiver for each transaction, applicable to transactions involving investment gold where such transactions are generally exempt from VAT, with partial limitation of the right to deduct”. In other words, the current VAT Law establishes certain requirements for it to be considered investment gold.

Therefore, investment gold will be exempt from paying VAT as long as it is physical gold, that is, gold bars or coins, such as the gold we offer through Preciosos 11Onze. In addition, this gold must meet minimum purity requirements: 99.5% in the case of bullion, and 80% in the case of coins. Bullion and coins that do not reach this purity will have to pay VAT at 21%, the same rate that applies to the purchase of other precious metals.

Income tax

Silver and other precious metals pay VAT like any other product, and each country applies its own tax rate, 21% in the case of Spain. Therefore, as investors, we have to bear in mind that these are different investments from gold, and often more speculative.

In terms of personal income tax (IRPF), any sale of gold, or any other precious metal by the taxpayer, has to be included in the tax return, and will be taxed according to the capital gains or losses generated by the operation, by the taxable savings base.

In this way, if a capital gain has been achieved with the operation, it will be necessary to reflect it taking into account the purchase price, including expenses, and the sale price, excluding expenses, with applicable rates depending on the amount.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

Market concerns about the volatility being generated by escalating tensions between Russia and the United States, combined with a subdued dollar, are driving safe-haven assets demand and pushing gold prices higher for the third day in a row.

The decision by Joe Biden’s administration to allow Kyiv to attack targets on Russian territory with US long-range ATACMS missiles has added fuel to the fire of the war in Ukraine and continues Washington’s escalation. This shift in US posture increases the possibility of the armed conflict spilling over the Russian-Ukrainian border.

Given that using these missiles requires the intervention of US military operatives, the Kremlin sees this decision as tantamount to a direct US entry into the conflict. The Russian government’s response merely reiterates what it had already announced a few months ago in the face of the possibility of NATO weaponry being used to attack its territory.

In this sense, following Russia’s confirmation of the first attack with these missiles against a military installation on Russian territory, Russian Foreign Minister Sergey Lavrov said that ‘it is a sign that the West is looking for an escalation’. Meanwhile, President Vladimir Putin has already approved a decree relaxing the requirements for the use of nuclear weapons.

Gold prices hit new highs

Against this backdrop, gold prices are recovering after plummeting to a three-week low in the face of Donald Trump’s decisive victory thanks to strong Treasury yields and a stronger dollar.

This precious metal’s price rose for the third consecutive day, diametrically opposed to the dollar, reaching a one-and-a-half-week high of around 2,500 euros per ounce. This appreciation has been mirrored by the value of other safe-haven assets and by the yield on 10-year US Treasuries, trading around 4.35% on Tuesday.

Although investors remain concerned about the risk of a further escalation of geopolitical tensions between Russia and the United States in Biden’s remaining two months in office, the inauguration of Donald Trump’s presidency is expected to signal the start of a possible negotiation to end the proxy war between these two powers on Ukrainian soil.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy at the best price the safe-haven asset par excellence: physical gold.

A report by Future Market Insights indicates that Litigation Funds will grow by 9.6% annually until 2033. The sector attracts the interest of investors due to the combination of high profits, lower risk and social justice. 11Onze, through the Litigation Funding that it offers with a British provider, anticipated the market trend.

Almost two years ago, 11Onze reached an agreement with a British provider to offer the people of La Plaça the possibility of participating in a product that we call Litigation Funding. The vision was simple: there are thousands of stagnant cases because it is necessary to assume legal expenses that people with few resources cannot afford. Would it be possible to finance these cases against the banks and administrations that have abused these citizens? Would it be possible, in addition to doing justice, to make money? The answer is yes, the product works and generates profits of between 9% and 11%. And it is not just 11Onze that claims it, but rather clients who have been generous enough to share their experience with La Plaça, such as Salvador, Dolors and Carme. All of them have participated, perhaps unwittingly, in what is currently considered the cutting edge of the investment sector.

The fashion sector

This is confirmed by a report by the American company Future Market Insights, which in an extensive work documents the evolution and prospects of litigation funds. In the report, they explain that “the market is expanding due to the increasing need for litigation funding from plaintiffs. This is driven by the increase in legal costs, as well as the desire of people and organizations to use litigation investment as a method of making money.” In this sense, they predict that globally, the litigation funding sector will grow at a rate of 9.6% annually until 2033. This, in terms of volume of money, means going from 17.16 billion dollars in 2023 to 43.048 billion ten years later.

Growth during these years will be supported, foreseeably, by a favourable regulatory framework that is facilitating the creation of firms specialized in litigation financing. In addition, large law firms are focusing on detecting cases that may mean quick victories but that, until now, could not be successful due to lack of financing. Currently, in the case of Litigation Funding that 11Onze Recommends, the percentage of victories is above 90% and in no case is the initial capital lost, because it is covered by insurance.

Banks and large investment funds

High returns and low risk have also attracted the big players in the financial world, and several large banks and investment funds are planning to enter the litigation funding sector. In this regard, at 11Onze we can only advise that investors, when receiving a proposal, carefully evaluate the risks and whether the proposal fits with their values. For example, according to the report, there will be a significant increase in litigation funding “in the media and entertainment sector, due to an increase in trademark and copyright infringement claims across the industry. In addition, the growing number of medical malpractice claims is expected to increase demand for litigation funding in the healthcare sector.” Which lawsuits the investor wants to participate in and what percentage of victories they guarantee is a matter that must be carefully thought out before participating.

The Litigation Funding that 11Onze Recommends

Currently, the product that 11Onze Recommends through its British provider is focused on lawsuits for bank and public administration abuses, in the latter case very focused on housing issues.

Fund lawsuits against banks. Get justice and returns on your savings above inflation thanks to the compensation the banks will have to pay. All the information about Litigation Funding can be found at 11Onze Recommends.

With prices soaring to record highs, the Chinese are turning to gold to protect their savings in a context of economic uncertainty and real estate crisis. As demand for gold jewellery plummets, sales of bullion and coins are soaring.

Three years after the collapse of Evergrande, China’s property crisis continues to put pressure on a central government facing a worrying economic slowdown. Some analysts are sceptical about the effectiveness of the central government’s proposed measures to boost homebuyer confidence and overall consumption.

Haibin Zhu, chief China economist at JPMorgan, told CNBC in early September that ‘the property market meltdown is not over yet’, adding that China’s ailing housing market will continue to weaken as the government’s series of stimulus and support measures have not been ‘satisfactory’ in shoring up the sector.

Against this economic backdrop, companies have cut wages, young university students are finding it difficult to enter the labour market and Chinese consumers, already prone to saving, have become even more frugal. This has led to a strong demand for gold from Chinese households, who, despite rising prices, continue to regard the golden metal as the best safe-haven asset.

From jewellery to bullion and gold coins

With gold prices having risen for almost two years now – since the beginning of 2024 alone they have already appreciated by 23% – and continuing to hit record highs, it is not surprising that jewellery sales have plummeted globally. In China, jewellery purchases fell 35% year-on-year in the second half of the year.

This is the second-weakest quarter for jewellery demand since 2020, when it was hit hard by the Covid-19 health pandemic. Even so, Chinese consumers and investors have not stopped buying gold, but have shifted away from jewellery to bullion and coins, sales of which are up 46%, according to data from the China Gold Association.

It is clear that Chinese households have turned en masse to buying gold because they have lost confidence in traditional investments such as real estate or stocks. It remains to be seen how the property market and the Chinese economy will evolve, but it is clear that the Chinese population’s demand for gold is far from a crisis.

To discover the best option to protect your savings, go to Preciosos 11Onze. We will help you buy the ultimate safe-haven asset, physical gold, at the best price.

Gold has risen 23% since the beginning of 2024 and its price remains at an all-time high of around 2,260 euros. Geopolitical tensions, central bank purchases and a weak dollar reaffirm gold as the safe-haven asset par excellence in times of economic uncertainty.

Gold prices experienced a notable rally on Tuesday on optimism that the Federal Reserve will cut interest rates this month and remain around 2,260 euros per ounce, as investors’ attention now turns to the US payrolls report due on Friday.

Also, the persistent demand for gold by central banks – they purchased more than 1,000 tonnes of gold last year alone, setting a new record – the weak dollar and global geopolitical tensions are the main factors that have kept the value of the precious metal at record highs.

This has been reflected in the significant price increase of 23% since the beginning of the year, outperforming stock market indices such as the S&P 500, which has risen by around 17%, and doubled its value in the last five years.

Outlook for the coming months

The financial market narrative remains unchanged, with optimism all around despite the occasional fluctuations in gold prices. The weak dollar, possible rate cuts and low US Treasury yields – 10-year bond yields have fallen 25 basis points in the last month – create a favourable environment for continued demand for gold.

Goldman Sachs said in its latest report on Tuesday that gold has the greatest upside potential in the near term, given its role as a favoured hedge against risk. Conversely, weak demand from China has led to a ‘more selective and less optimistic’ outlook on other commodities.

‘The Fed’s impending rate cuts are poised to drive Western capital back into the gold market, a component largely absent from the strong gold rally seen over the past two years,’ the Wall Street bank stated in its “Go for Gold” note. That said, it adjusted its gold price forecast to $2,700 (€2,444) in early 2025 from the previous forecast of late 2024, citing a price-sensitive Chinese market.

On the other hand, sustained demand from central banks around the world that bought a record 483 tonnes of gold in the first half of 2024, pushing the asset to an all-time high, suggests that the precious metal will maintain its safe-haven appeal in the months ahead.

To discover the best option to protect your savings, go to Preciosos 11Onze. We will help you buy the ultimate safe-haven asset, physical gold, at the best price.

If you already trade cryptocurrencies through the Bitvavo platform that 11Onze Recommends, we give you 6 tips to increase the security of your account. Take advantage of Bitvavo’s tips and promotions and learn how the world of cryptocurrencies works.

During this month of July Bitvavo is offering two promotions for those users who sign up to the platform. But not only this, it also gives us ideas to improve the security of our account. To explain:

- Enabling two-factor authentication. The first step in securing your Bitvavo account is to enable two-factor authentication (2FA). This adds an extra layer of security in a very simple way: by requiring a unique code generated by an authentication application. This makes unauthorised access much more difficult, so it’s a great barrier against hackers.

Another thing: if you use an authentication application, one of those that recognise you on all devices, do not synchronise Bitvavo codes with your personal account. Keep them only on your device. - Use a strong password. How can you create a strong password? Well, it’s not complicated: avoid using common words, phrases or personal information that can be easily guessed. A combination of upper and lower case letters, numbers and special characters is always recommended. But do yourself a favour and write it down somewhere so you don’t forget it!

- Keep your account information private. It’s a no-brainer, but it’s worth remembering: never share your Bitvavo account details with anyone. This includes your password, security question and API keys. Also, beware of phishing scams and fake emails that may try to steal your personal information. Remember, neither Bitvavo nor 11Onze will ever ask for your account information via email or a phone call.

- Secure your email. Your email is linked to Bitvavo, so it would be a good idea to enhance your security as well. That’s why you can activate two-factor authentication and regularly check for account leaks. There are tools to check for this, such as haveibeenpwned.com. Another option is to create an email address just for your Bitvavo transactions.

- Use the anti-phishing code. If you activate the anti-phishing code, it will be included in all automatically generated emails sent by Bitvavo. With this code, you can check if the email really comes from Bitvavo. You can change your anti-phishing code by following the instructions here. Or by watching the video linked below.

- Try to stay informed. Regularly check your accounts, the official blogs and La Plaça. This will help you stay informed about any security issues or updates to the platform.

- EXTRA: Blocking fund withdrawals. Bitvavo also allows you to totally block withdrawals. This way, you can only trade in cryptocurrencies, but you can never withdraw money in euros. This prevents the possibility that someone can impersonate the user and download the money. The Dutch platform explains in this article how to block deposit withdrawals and how to re-enable them when necessary.

How to use the anti-phishing code.

11Onze Recommands Bitvavo, cryptocurrencies easily, safely and at a low price.

The volatility of the markets in August 2024 has shown, once again, that reality is stubborn and the safe haven par excellence is gold. Bitcoin is the most well-known and safest cryptocurrency out there, and has generated huge gains in recent years, but when panic hits Bitcoin seems to follow the market trend while gold appreciates.

There are those who say that Bitcoin is digital gold. It’s a way of saying that Bitcoin is very secure, and it is. But the truth is that only gold is gold and, this August, it has become very clear. Last week, gold again broke another historical record, reaching 2,531 dollars per ounce, that is, around 80 euros per gram. Currently, the rise has corrected slightly, but everything indicates that it will continue to rise, and it has already done so by almost 17% so far this year. What is happening?

Bitcoin, digital gold?

Between the 4th and 5th of August, the international markets suffered a shock that caused immense losses in many assets. Bitcoin had, in those days, a behaviour similar to high-risk capital values, that is, it went down following the market. The World Gold Council has analysed the evolution of assets in those days, very specifically comparing gold and Bitcoin. And the conclusion is strong: it is very volatile. Therefore, nothing digital gold because Bitcoin does not (apparently) have one of the essential conditions to be considered a safe haven value: being able to withstand market turbulence. It’s a great asset for big gains, it’s been proven for a long time, but it doesn’t work as a safe haven.

In the same period, and throughout the month of August, gold has been revalued. Because, historically, gold gains value in difficult times. When everything is volatile, physical gold is always there. This is what the American financier Michael Burry, famous for having predicted the subprime mortgage crisis of 2008, must have thought. On August 4, seeing how the markets were evolving, Burry made a large purchase of gold. This fact put the whole market on alert and pushed the price up.

Will the recession come?

Gold has continued to rise due to the possible rate cut by the American Federal Reserve, which could put the world’s first economy into recession. It’s a long-announced recession that never seems to end. At the moment, gold continues to gain value, that is to say, big investors are preparing for the curves.

If you want to discover the best option to protect your savings, enter Preciosos 11Onze. We will help you buy the ultimate safe haven value at the best price: physical gold.

Es consideren dipòsits de valor aquells actius, divises i mercaderies que no es devaluen amb el temps. L’or i altres metalls preciosos han estat històricament els dipòsits de valor per excel·lència, mentre que en les últimes dècades s’han fet evidents les grans deficiències de les monedes fiduciàries.

Com indica la Investopedia, “un dipòsit de valor és essencialment un actiu, mercaderia o divisa que pot guardar-se, recuperar-se i intercanviar-se en el futur sense que es deteriori el seu valor” quan l’intercanviem per productes o serveis: si avui equival a deu pomes, passat un temps haurem de poder intercanviar-lo per, com a mínim, deu pomes també.

L’or i altres metalls preciosos han estat considerats al llarg de la història els dipòsits de valor per antonomàsia perquè la seva vida útil és pràcticament il·limitada. I, si comprovem l’evolució del preu de l’or en les últimes dècades, veurem que una unça ha passat de cotitzar per sota dels 300 dòlars quan va entrar en circulació l’euro l’any 2002 a superar els 1.900 dòlars en l’actualitat.

En l’altre extrem, productes peribles com les pomes són pèssims dipòsits de valor perquè en pocs dies es descomponen i perden tot el seu valor. Tot i que determinats productes bàsics com els aliments poden pujar de preu temporalment en funció de la situació del mercat, el seu caràcter perible impedeix considerar-los dipòsits de valor.

Els diners moderns suspenen com a dipòsit de valor

Òbviament, l’euro i la resta de les monedes fiduciàries són dipòsits de valor molt deficients perquè no es revaloren al mateix ritme que els productes i serveis que permeten adquirir. Encara que les nostres monedes haurien de ser un dipòsit de valor raonablement estable, la inflació fa que el cafè que fa uns anys compràvem en un bar per un euro avui dia ens costi bastant més. Els nostres diners es deprecien dia rere dia.

Richard Nixon va posar fi al patró or l’any 1971, que fins llavors obligava als països del Fons Monetari Internacional (FMI) a mantenir un tipus de canvi fix respecte al dòlar i a la Reserva Federal dels Estats Units a recolzar la seva divisa amb or. Des de llavors, utilitzem monedes fiduciàries, és a dir, monedes que són de curs legal però que no estan recolzades per cap bé valuós. Tots els bancs centrals poden fabricar diners segons la seva conveniència i el seu únic aval és la confiança dels ciutadans.

Com és lògic, si la quantitat de diners en circulació augmenta a un ritme més elevat que els béns i serveis que es poden adquirir amb ells, el desequilibri entre l’oferta i la demanda fa que s’apugin els preus. Per tant, els nostres diners es devaluen.

Una moneda raonablement estable és essencial per a la salut de l’economia. Una unitat monetària que funciona malament com a dipòsit de valor desincentiva l’estalvi i dificulta el comerç. Els seus efectes nefastos són evidents si donem un cop d’ull als casos d’hiperinflació que han viscut alguns països al llarg de la història.

Els metalls preciosos com a valor refugi

Al llarg de més de dos mil·lennis, moltes economies han utilitzat l’or i altres metalls preciosos com a moneda de canvi per la seva durabilitat, relativa escassetat i fàcil transport. A més, en les últimes dècades l’or ha tingut un paper important com a valor refugi. La seva demanda ha tendit a disparar-se en moments d’incertesa econòmica, com demostren les dades de l’any passat, el de major demanda des de 2011. La llarga experiència amb l’or permet avalar la seva capacitat per exercir com a dipòsit de valor a llarg termini.

En general, altres actius com els béns immobles, les obres d’art, les antiguitats o alguns objectes de col·lecció també han demostrat que poden tenir aquest rol. Tot i que el seu valor pot caure en moments puntuals, tendeixen a revaloritzar-se a llarg termini gràcies a una demanda més o menys constant i una oferta molt limitada.

El seu gran inconvenient respecte a l’or és que es tracta d’actius molt poc líquids: és difícil vendre’ls de manera immediata si volem fer-ho per un preu raonable. A més, aquests mercats exigeixen un bon coneixement i es ressenten especialment en les crisis econòmiques, quan més es tendeix a recórrer als dipòsits de valor.

I els criptoactius?

Més difícil és valorar si els criptoactius arribaran a considerar-se algun dia com a dipòsits de valor, ja que són massa recents. És cert que el bitcoin es basa en el principi d’escassetat, una característica pròpia dels dipòsits de valor: cada any es genera un número limitat de bitcoins i existeix un topall predeterminat. No obstant això, com tants altres criptoactius, el seu gran inconvenient és que manca d’un valor intrínsec. Gairebé tot el seu valor és ara com ara subjectiu, la qual cosa és terreny adobat per a la volatilitat.

Això sí, en la mesura que el bitcoin sigui acceptat de manera massiva com a mitjà de pagament i s’empri en un nombre creixent de transaccions, el seu valor s’enfortirà i augmentaran les probabilitats que arribi a ser un dipòsit de valor a llarg termini, més enllà de volatilitats puntuals.

Si vols descobrir la millor opció per protegir els teus estalvis, entra a Preciosos 11Onze. T’ajudarem a comprar al millor preu el valor refugi per excel·lència: l’or físic.

Gold remains the ultimate safe-haven asset for people who want to protect their savings from persistent inflation. However, as with any investment, it is important to know and consider the pros and cons of investing in this precious metal.

Gold’s ability to offer protection against inflation and maintaining or increasing its value in economic crises, makes it a must-buy if we want to diversify and make our savings profitable.

This fact has been confirmed since inflation began to rise in 2021, reaching its highest level (7.4%) in 30 years in March 2022, causing many households to suffer with resignation a drop in their purchasing power and the loss of a large part of their savings.

Although inflation has slowed down, it remains at 3.6% in Catalonia, according to the latest data issued by the National Statistics Institute (INE). This is a rate of inflation that neither the low yields of bank deposits nor the Treasury bills have been able to compensate for.

In contrast, over the last five years, gold has experienced a spectacular increase in value, doubling its price. As for 2024, during the first six months of the year, its value has risen by 12%, following the upward trend of 2023, outperforming most of the main investment assets and reaffirming itself as the most valuable asset on the market.

However, although buying gold can be a very good option to protect our savings and can help us obtain liquidity in case of need, it is crucial to evaluate the advantages and disadvantages of putting our money into this type of investment.

The good news

- Holds its value: Gold continues to be the ultimate safe-haven asset and an unparalleled store of value that tends to appreciate in the face of market uncertainty.

- Protection against inflation: As explained above, gold has proven to be a good hedge against inflation and the devaluation of our savings.

- High liquidity: Thanks to its intrinsic value, it is a highly liquid asset that can be easily sold, making it easy to convert into cash in case of need.

- Investment diversification: The price of gold often moves inversely to the stock and money markets, acting as a hedge in periods of volatility and helping us to diversify our investment portfolio.

The not-so-good

- Barriers to entry: Investing in physical gold can require a significant initial outlay. Although there are alternatives such as investment funds, not everyone has easy access to these options. At 11Onze Preciosos we make collective purchases so that we can get the best deals for all members of our community.

- It does not generate passive income: Unlike other investments such as shares or bonds, gold is an asset that does not generate dividends or interest. This means that, as a rule, investors do not receive regular income from owning gold. However, there are products such as Gold Seed, which can generate regular, passive income from gold buying.

- Storage costs: Physical gold needs secure storage such as safes or professional storage services. A safekeeping service ensures that your gold is protected and insured, but this comes at a cost. In return, at 11Onze Preciosos, when the time comes, we take care of selling the gold of our clients who have contracted a safekeeping service with us at the best possible price.

Preciosos 11Onze makes it easy to buy gold, at the best price and with total security. Give us a call and speak to one of our agents without compromise to clarify any doubts you may have and protect yourself from economic crises with the ultimate safe-haven asset.

Registered with the Dutch Central Bank and headquartered in Amsterdam, Bitvavo is one of Europe’s leading digital asset exchanges. It launched in 2018 offering reasonable fees, security and a simple and easy to use platform that has made it an ideal choice for beginners and experienced users alike.

In the five years since its market launch, Bitvavo has been driven by its founding pillar of making cryptocurrencies accessible to everyone. It was entering a sector dominated by US-based exchanges that were pioneers in facilitating the exchange of digital assets, but which needed to be more intuitive for people inexperienced in trading cryptocurrencies and had some shortcomings in terms of the security they offered to their users.

As Mark Nuvelstijn, CEO and co-founder of Bitvavo, explains: “The high threshold for buying and selling cryptocurrencies concerned us. Of course, there were large international traders, but you could only deposit euros in some places, and you couldn’t trade in altcoins. It was also not possible to store them securely.”

Buying and selling cryptocurrencies securely

Bitvavo is regulated and registered with the Dutch Central Bank, its depositors have access to the Deposit Guarantee Fund, so up to €100,000 could be recovered in the event of the exchange’s bankruptcy. In addition, the platform uses cold wallets so that in the event of a cyberattack, Bitvavo could restore deposits. In other words, customers’ digital currencies are regularly downloaded to physical devices without an internet connection.

However, Bitvavo wanted to take it a step further and offers additional protection: “Bitvavo’s cryptocurrencies are insured up to 250 million. As for the euro funds, they are also stored in a separate secure entity. In addition, we are working on account insurance to guarantee up to 100,000 euros,” Nuvelstijn notes.

Access to a wide range of cryptocurrencies

Bitvavo allows you to store, buy, sell and withdraw more than 190 digital currencies. When trading cryptocurrencies, you will have the option to store tokens in the exchange’s own wallet, which is free to use.

The process of signing up to the platform is simple, you can do it via the 11Onze Recommends link. In addition, until 15 August, Bitvavo is rewarding €500 to Binance and OKX users who transfer their funds from these exchanges, which can be used for the purchase of digital assets. Here is a tutorial on how to do it.

11Onze Recommends Bitvavo, cryptocurrencies easily, securely and at a low cost.