Workation: combining work and holidays

The confinement in the wake of the pandemic popularised remote working. A trend that has blurred the boundary between the office and our personal lives. Workation is a new form of telecommuting that merges work and holidays.

For anyone who has the option to work remotely, the benefits of taking a workation, the sum of ‘work’ and ‘vacation’, are hard to pass up. Until 2019, the image of working from a laptop with a panoramic view in the background was almost exclusively associated with a digital nomad lifestyle, but, thanks to the sanitary crisis, telecommuting became exponentially more popular.

This new form of remote work is not designed for you to work while on holiday, but to work as if you were on holiday. Setting up our office in a place we would normally only visit when we are on holiday can have many benefits beyond the view.

You’ll still have all the essentials you were used to in office life and many luxuries you didn’t have

From sturdy workstations built for hours of tapping away on your laptop, access to conference rooms made available when needed, all the way to a strong Wi-Fi connection that won’t quit, many hotels offer a large variety of beautifully designed spaces that you can move through depending on your mood and preferences.

In many ways, hotels served as the original version of coworking spaces, it was common to see people in suits with laptops flipped open while enjoying a meal in the restaurant. Today, you’re more likely to find someone wearing shorts and flip-flops.

You’ll increase your productivity

As digital nomads are 13% more productive than their in-office counterparts, it turns out employers also see the benefit in their employees working from abroad. Being able to work in a space tailored to individual needs and preferences, as well as having uninterrupted blocks of time during the day, all means that people are not only more productive and comfortable at work, but they’re also much more willing to occasionally put in extra hours in order to get things done.

Your mental health will thank you

Feeling the winter blues coming on? Getting overwhelmed by work, or finding it tough to keep up with office politics? Maybe you could use a change from the home-to-office routine you’ve become so used to; something to remind you that life is for living, and not just working and commuting.

You’ll relax, without having to take time off work

Many hotels have amenities that, let’s face it—most of us simply just don’t have at work or home. Ditch the communal shower, pool table, and stiff massage chairs in favour of the hotel pool, steam room, and sauna—where you can unwind after a day of hard work, without even going outside. The more you use those precious after-work hours to unwind and recharge, the more you go into your working hours feeling fulfilled, refreshed, and focused.

You’ll discover new places

Exchange predictable commutes for lengthy walks in an unfamiliar city; explore different districts and restaurant recommendations; try your hand at leisure photography; or broaden your horizons by meeting locals and doing a deep dive into your local culture. Become friends with the barista at that coffee shop you frequent daily, or do some research on where to go and what to see from your new location.

Do you love to travel? With 11Onze Viatges you can book accommodation at the best price, without stifling the travel industry.

Sembla obvi, però, per aprendre a administrar els nostres diners, és primordial, primer, que ens els hàgim guanyat. Aconseguir diversificar els nostres guanys és una estratègia que ens pot blindar enfront d’una possible recessió o d’un imprevist. A 11Onze recopilem tres consells bàsics per fer-ho.

En moments d’incertesa és clau saber respondre a: com estalviar, com fer créixer els estalvis i com controlar les despeses. Difícilment serem experts a trobar respostes per totes tres preguntes alhora, però, si entenem els conceptes que s’amaguen rere cadascuna d’elles, tenim moltes més possibilitats de gestionar els nostres diners adequadament. No només aprendrem a cobrir les necessitats bàsiques, sinó que sabrem gaudir-ne i tindrem molt clar quan hem de prescindir d’aquelles que no ho són tant com ens pensàvem.

Estalvi: almenys un 10% dels ingressos

Sovint es diu que l’estalvi és la base principal de l’èxit financer. Tenir diners estalviats és el que ens dona la capacitat de respondre a situacions imprevistes —bé sigui una incapacitat per malaltia o càrrecs inesperats—, començar un negoci o tornar a estudiar. Però és important no confondre l’estalvi amb la inversió: mentre que el primer ens dona tranquil·litat, fins i tot en moments de crisi econòmica global, la inversió pot fer que els nostres estalvis es multipliquin, però també pot ser una font de maldecaps i la causa que perdem la nostra liquiditat.

Un dilema que ens podem trobar és si liquidar el deute o estalviar. Tot dependrà del tipus d’interès que tingui aquest deute. En casos d’interessos alts, com poden ser els de les targetes de crèdit, és generalment preferible deixar aquest deute a zero abans de plantejar-se l’estalvi. Però, en casos en què l’interès del deute sigui baix, com pot passar amb una hipoteca o, fins i tot, un crèdit personal, és raonable estalviar i alhora liquidar el deute lentament.

Creixement lent, risc baix, i a la inversa

Un compte d’estalvi ha estat la manera més tradicional que creixin els nostres diners, sobretot per a la gent més conservadora i poc aficionada al risc. Però, amb interessos relativament baixos i una inflació que ens visita molt més sovint del que seria desitjable, altres formes d’inversió van guanyant terreny, especialment davant d’una clientela cada dia més erudita en temes financers i amb un poder adquisitiu relativament superior a les generacions precedents.

En aquest punt, l’oferta de productes d’inversió és extensa i variada, amb diferents nivells de risc. Cadascú ha de ser conscient dels seus coneixements financers i, sobretot, de la quantitat de diners que s’està disposat a arriscar i perdre, especialment si l’expectativa de creixement és elevada i a curt termini. Cal tenir en compte que un gestor d’inversió pot ser una molt bona opció a l’hora d’escollir un producte financer que millori la rendibilitat dels nostres estalvis d’una manera substancial.

Despeses: necessitat vs. desig

Evidentment, no estalviarem tot el que guanyem, però hem de distingir entre dos tipus de despeses:

- Despeses de primera necessitat. Aquí hi comptem les despeses en el que és bàsic que necessitem per viure, com poden ser el menjar, l’allotjament, els subministraments d’electricitat, l’aigua, el transport públic, entre d’altres.

- Desitjos i productes més superflus. Per eliminació, hi incloem tot el que no és estrictament necessari. Hi trobaríem les compres impulsives, articles de luxe, viatges de lleure, etc.

Fer aquesta distinció no implica que no puguem gastar diners en coses que desitgem, però que no necessàriament ens calen. El desig i les accions que no tenen una finalitat merament pràctica són part de la condició humana. Això és un fet. Per tant, també ens hem de permetre aquestes despeses, sempre que ens adherim a un pressupost preestablert, bé sigui setmanal o mensual.

11Onze és la fintech comunitària de Catalunya. Obre un compte descarregant la super app El Canut per Android o iOS. Uneix-te a la revolució!

Taking out home insurance is essential to protect ourselves against incidents that may affect our home, but it is often not easy to understand the policy terminology. We explain some basic concepts you ought to know.

A home insurance policy is a contract by which the policyholder (the person who takes out the policy) pays a premium (amount of money) to the insurance company in exchange for being guaranteed coverage for a risk that is defined in the policy. For this reason, it is important that, when taking out the policy, you study each of the clauses of the contract carefully. We help you to familiarise yourself with the terminology used by the insurer to make the whole process easier.

Building

The building is understood to be all the structural elements of a property, that is to say, the foundations, walls, ceilings, doors, windows, as well as the electrical installation, water and security devices. Basically, all those elements that if we were to turn the house upside down would not fall, as well as any structure attached to it (the garage, the swimming pool…).

You have to bear in mind that each insurance company may have small variations when considering which elements make up the building. Even so, you should be aware that the amount of the building cover does not represent the purchase price or the current market value, but the cost of rebuilding the home.

Contents

The contents refer to all those elements or goods found inside the property: furniture, electrical appliances and other electronic devices, as well as clothing, jewellery, works of art and any valuable personal effects. Contents cover can help you recover the cost of replacing your items that have been damaged in various situations, or that you have lost in the event of theft.

Bear in mind that you will need to make a list of all items before taking out insurance, and belongings above specifically stated values will require additional cover. It is also important to remember to let the company know if you want to add any new items you have acquired after signing the policy.

Civil Liability

Civil liability cover protects against damage caused to third parties by those legally responsible. In the case of home insurance, it covers the person who has taken out the policy or any member of their family (including pets if they are added to the policy) living in the home, for incidents in the home that may affect another person.

This is an essential type of cover in any home insurance policy. A water leak that causes damage on the floor below, a flowerpot that falls from your balcony onto a car, or the breakage of a neighbour’s window while your children are playing ball, are examples of incidents that would be covered.

Watch out for the small print

Yes, it’s a no-brainer, but we must read the small print of our policy carefully to avoid last-minute surprises. For example, terms such as burglary and theft may seem similar, but while many policies cover damage caused in case of burglary (subtraction of property by use of force or violence), other companies do not insure you in case of theft (theft of property due to negligence), as may be the case if you have left your front door open.

The lack of maintenance of a property or not taking the corresponding precautions if you have a dangerous dog are two more examples of imprudent actions that could be classified as negligence, and which would not be covered by the majority of home insurance policies.

And finally, shop around before you buy. The insurance market offer is very varied thanks to the entry of insurtech and the competition between different companies. Take the time to make a comparative study that will allow you to find the option that best suits your needs and the type of home you want to insure.

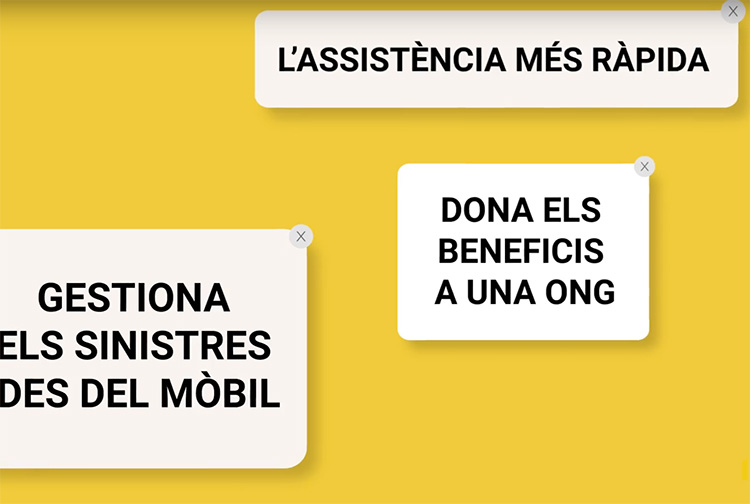

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

Beyond the convenience of having home insurance to deal with unforeseen events, there are circumstances in which homeowners or tenants may be legally obliged to take out this type of insurance.

Seven out of ten people in Catalonia already have home insurance. In many cases, having such insurance is simply a matter of choice to save headaches in the event of a claim. However, in other situations, homeowners or tenants are legally obliged to take out such insurance.

As 11Onze agent Amadeu Vilaginés points out, a homeowner may be obliged to take out home insurance when applying for a mortgage, but he clarifies that the bank can only oblige us to take out basic cover and that we are free to do so with the insurer of our choice, as stipulated by European regulations. In the case of tenants, they are only obliged to take out this type of insurance when this is indicated in the signed rental contract.

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

Have you checked the coverage of your home insurance? It is worth checking how it reflects some aspects that could lead you to overpay or receive limited compensation in the event of a claim. We offer some recommendations to protect you from unpleasant surprises.

Building cover covers the cost of repairing or rebuilding your home in the event of a disaster. To differentiate it from the contents, a very graphic formula is to imagine that we can turn our home upside down. Everything that would fall down would be the contents, while what would not fall down would be the building.

Keep in mind that the value of the building coverage does not represent the purchase price or market value of your home. Nor should it include the value of the land on which the house or building was built. In reality, it is the amount that would be needed to rebuild the home back to the way it was. This value is known as the “reconstruction cost”.

Home insurance also includes a section dedicated to your “contents”, or your things (TV, clothes, computer, bicycle, etc.). The amount that appears in that section is the amount that the insurance will pay you as a maximum if something happens to your things, so it should more or less correspond to their real value.

The clauses of the policy, under scrutiny

Here are some elements that you should take into account so that you don’t overpay and so that the insurance doesn’t underpay you in the event of a claim:

- Avoid duplication. If your building has insurance, check its coverage, as you will be able to exclude from your policy the elements of the building that are already included in the community insurance. Bear in mind that, in the event of a claim, if an element is covered by both the community insurance and your private insurance, you will not be paid twice.

- Make sure the valuation of the building is correct. If the sums insured are much higher than the value of your home, you are paying for protection that you do not need, as, in the event of a claim, the insurance will only pay for reconstruction, nothing else. On the other hand, if the reconstruction value of your home is higher than the insured sums, the insurer will only pay up to the insured sums, leaving you with a shortfall in your recovery. Therefore, you should adjust your policy to be slightly above the value of your home, but without paying for unnecessary cover. As a guideline, bear in mind that the valuation should range from around 800 euros per square metre for normal flats to 1,300 euros for a detached house.

- Check that the valuation of the contents is adequate. Be aware that insurers impose limits on the individual value of the personal things they cover by default. Normally, your valuables will need additional cover. You need to register them, or your insurance will only reimburse you up to the individual limit you have by default in your policy. We recommend that you take photos (or a video) of all your things. To estimate their value, first, make a list of the valuable items and calculate their cost, and then estimate the figure for less valuable items such as clothes and kitchen utensils and round up their value.

- Keep an eye on how glass cover reflects. Glass cover includes everything from windows to mirrors. You should make sure that windows are included among the building covers, while mirrors are included in the contents. Sometimes insurers use this separation to exclude part of the windows from the coverage, so check if they are all covered.

- Consider coverage for aesthetic damage and sanitary ware. Toilets, worktops and other items should be protected by these coverages. Some insurers include these elements as part of the contents, which can be detrimental if the insured capital is lower than the real one. In addition, it can lead to bathrooms and kitchens being excluded from specific coverage, such as aesthetic damage if only building damage is covered and bathrooms and kitchens are considered as contents. You should check that the coverage for aesthetic damage covers the necessary repairs to maintain the aesthetic uniformity of your home after an incident, as insurers play a lot with the limitations of this coverage, especially in bathrooms and kitchens. Make sure that your insurance covers sanitary ware as a building and does not have hidden exclusions. Neither does the clauses regarding aesthetic damage, which must cover a minimum capital of 2,000 euros.

- Make sure that the insurance covers the replacement value of the contents. The actual value is the value that most insurers calculate to replace your stolen or damaged items. It is calculated on the basis of what the same item would cost today (the replacement value) minus the loss of value due to age, wear and tear (depreciation). Hence, the importance of the insurance not covering the actual value, but the replacement value, which is the price for which your item (of the same maker and model) could be bought today if it were new. In short, the replacement value is the market price. If your insurance uses the actual value, you will probably want to look for insurance with a similar price but using the replacement value.

- Check that the policy includes legal defence. Without such coverage, your insurance will not offer you the support of a lawyer in the event of a legal dispute. This is one of the first coverages that insurers tend to cut back on in order to offer lower prices.

- Check if the price reflects security features. The fact of installing a security door makes most insurers lower the price of coverage related to burglary. The same applies to security measures such as alarms or grilles. Also, elements such as smoke or water sensors should help you reduce the price of water-related and fire-related coverages. Make sure that these modifiers are included in your insurance if you have them.

We can highlight that it is essential you review the insured capitals and adjust them to the characteristics of your home; check that all the limits are adequate and cover what you expect, and that your insurance includes some modifiers in the price to adjust what you pay each year to the changes you make to your home.

If you want to discover fair insurance for your home and for society, check 11Onze Segurs.

What will the job of the future look like and what skills will we need to succeed? To answer these two questions, the McKinsey Global Institute has conducted extensive research and concluded that we will need to master at least 56 skills to secure a job, higher wages and greater well-being at work.

The institute has classified these 56 skills in the study into four broad blocks: manual and physical skills, which will be of decreasing interest; and high-value technological, social and cognitive skills, which are gaining in importance. The McKinsey Global Institute surveyed more than 18,000 people in 15 countries and aims to get governments and companies to prioritise work teams that meet these requirements.

For starters, the institute points out in the report that, while there will continue to be many skilled jobs, the new technological revolution we are heading towards, which has been accelerated by the pandemic, will increasingly require more dynamic, creative and digital people. It will therefore be essential to add value to the automated and artificially intelligent systems that are taking hold in many companies. It will also be necessary to adapt and train constantly in the digital environment, achieving new skills. For this reason, they believe that governments need to start promoting new educational plans to prepare adults and young people for the new scenario.

Cognitive skills: creativity and adaptability

- Solving problems in a structured way.

- Control logical reasoning.

- Understanding differential features.

- Knowing how to search for relevant information.

- Organise a work plan.

- Prioritise tasks within a given time.

- Agility of thought.

- Ease of learning.

- Good public speaking skills.

- To get the right questions right.

- Synthesising messages.

- Listening skills.

- Imagination and creativity.

- Transferring knowledge to different contexts.

- Adopting different perspectives.

- Adaptability

Interpersonal skills: empathy and collaboration

- Modifying the role when necessary.

- Reaching consensus.

- Always having an inspiring vision.

- Organisational awareness.

- Demonstrate empathy.

- Inspire trust.

- Maintain humility.

- Be sociable.

- Encourage diversity.

- Motivate emotional situations.

- Resolving conflicts.

- Collaborate.

- Helping.

- Empower

Leadership skills: integrity and motivation

- Understanding the emotions of others.

- Having self-control.

- Knowing one’s own strengths.

- Integrity.

- Knowing how to motivate oneself.

- Self-confidence.

- Taking risky decisions.

- Leading change and innovation.

- Energy, passion and optimism.

- Break the mould.

- decisiveness

- Clear direction.

- Persistence and perseverance.

- Accepting uncertainty.

- Striving for emancipation.

Technology skills: cybersecurity and ethics

- More digital literacy.

- Expanding digital knowledge.

- Knowledge of digital collaboration networks.

- Digital ethics.

- Learn programming.

- Know how to analyse data and statistics.

- Have algorithmic thinking.

- Be trained in Big Data.

- Know about cybersecurity.

- Be up to date in intelligent systems.

- Know how to translate technology into useful actions.

If you want your business to make a giant leap, use 11Onze Business. Our business and freelancer account is now available. Find out more!

The framing effect is a cognitive bias according to which the same information, presented in different ways, can lead us to different conclusions. Lara de Castro, from the Human Resources team at 11Onze, explains how this distortion of perception can affect our day-to-day decisions.

We all like to think that when it comes to making a decision or a choice we follow our criteria with a certain objectivity, but as Lara de Castro explains, “our critical thinking is not as impartial as we think it is, but rather we respond according to how the question is posed to us”.

There are countless examples of how cognitive bias determines people’s decision-making. It is a cognitive framework where people decide on one option or the other depending on whether the options are presented with positive or negative connotations. For example, if you have to undergo surgery, and you have to sign a document to give your consent: if you are told that there is a 90% chance that it will go well, you are more likely to sign the document than if you are told that there is a 10% chance that it will go badly.

Taking advantage of this intrinsic cognitive bias in people based on how the brain makes comparisons between positive vs. negative, loss vs. gain, better vs. worse, etc., makes it easier for “people, governments and companies that dominate communication to do what they want with us”, says de Castro.

De Castro makes a reflection in this sense: “If we focus on the world of finance, this bias is even scarier, because it suggests that the decisions you make in relation to your personal finances are determined by the way the question is posed, and by whom it is posed”. Hence, the importance of financial education, as being informed is the only antidote that has been shown to be effective against marketing techniques that exploit cognitive bias to influence our decision-making.

11Onze is the community fintech of Catalonia. Open an account by downloading the super app El Canut for Android or iOS and join the revolution!

Surely you’ve heard the word start-up more than once. But what does it mean? What skills do you need to work at one?

A start-up is an emerging, newly-created company, with high growth potential, linked to new technologies or innovative business models, and with a high rate of return.

To work at one, you need to have a passion for your project, motivation to bring it to fruition, flexibility to dedicate hours to it and do the tasks that must be carried out, and commitment to the company. But if you do what you love, can it be considered work?

5 key skills to work at a start-up

- Proactivity: these types of companies do not just look for people in search of work, but want professionals that offer them services and believe in the idea.

- Positive attitude and professionalism. Not only do they look at resumes, but they also value the energy that candidates exude. Attitude will be key.

- Adaptation: people who adapt to everything and are willing to pursue their passion, who are disruptive, too, and don’t settle for everything.

- Differentiation: they look for passion rather than talent, people who believe in the project, who share the values of the start-up. You have to be different and creative.

- Flexibility: versatile people with autonomy.

Focused on work by goals

You can already say goodbye to schedules: the traditional office workday has no place in a start-up, and priority is given to the project and delivery times. You have to be careful, because this becomes a double-edged sword: it favours the flexibility of workers’ schedules, but at the same time you can work too many hours if you do not manage this properly.

In most cases, it will be indifferent whether you prefer to work in the morning, in the afternoon, or on Sunday night: what matters is that the task is delivered when it has to. Everyone needs to be organized in the way that is most productive for them. Generally, specialized people are sought, but, taking into account the work methodology, it is equally important that they are flexible, open-minded, good team workers, good learners, and quickly adaptable to change.

Dismantling myths about start-ups

The flexibility and constant change of start-ups implies, even if it seems the opposite, more organization than in conventional companies. If you have not been selected as a candidate, the best thing you can do is keep in touch, as there may be a place for you in the future. It is also not true that it is limited to young people: they need experienced people and, contrary to popular belief, if the company has good future prospects, salaries are usually competitive.

The selection process is also not usually traditional, as personal and professional characteristics that go beyond the curriculum are valued. The preparation for the interview will be key: find out what they do and how they work, and look for aspects of the project in which you can contribute. And, above all, be different. Any HR person is used to seeing hundreds of resumes a day. Do not miss the opportunity, and take out your best weapons to attract attention. Get away from the conventional. It is a good idea to achieve other skills apart from the current one, to train in other skills such as Excel, HTML, or WordPress. Note that most start-ups revolve around technology, and sooner or later you will have to use them.

Proactivity and emotional intelligence: the combination of success

Working at a start-up will be an adventure where nothing is permanent. Even your position may change, and you may end up in a different department. Remember the skills above, and don’t be afraid to make mistakes. Proactivity will be your best ally.

Lastly, you need to have knowledge of emotional intelligence, to manage behaviour, relationships, and decisions. For everything that happens to bring you to fruition, you must reduce negative emotions, know how to manage stress, be more assertive, stay proactive, and bounce back to adversity. Paying close attention to the emotions of oneself and others, especially in difficult times or of a certain intensity, will help us a lot.

What matters in a start-up is the will to improve, to do whatever it takes, and to have the passion to do it.

If you want your business to make a giant leap, use 11Onze Business. Our business and freelancer account is now available. Find out more!

Have you ever had the feeling that you are wasting time while attending a meeting with your teammates and/or your boss? You are in the meeting, but are you thinking about other things? Can these sensations be avoided by making meetings more efficient? We try to explain how.

According to team building and leadership specialists, one of the essential issues is to be clear about why you are calling a meeting. Sometimes, we have the feeling that we are in that room, simply because you have been told to or because it’s on the calendar, without a defined objective.

Nowadays, and after everything that has happened in the last year, there are also those who distinguish between the organisation of face-to-face meetings and virtual meetings, given that the latter are not always easy to control, either because everyone is talking at the same time or because the attendees’ connections start to fail.

But in any case, the essential guidelines are the same:

- Before convening a meeting, whether it is face-to-face or virtual, we must be clear about the objective: What do we want to achieve? Is it really necessary?

- If possible, it should be planned with enough time to inform the interested parties, so that they can prepare for the meeting as well as the convenor, and so that the time is used to the maximum. Similarly, if necessary, it is advisable to provide attendees with the necessary documentation.

- The invitation should only reach the essential people. There is no point in having 20 people attending if only 5 are really interested and/or affected. For the company, time is money, and it is not productive to have a lot of people as forced spectators.

- Calculating the duration of the meeting is also important to avoid it taking longer than necessary, and obviously you have to be punctual in order to keep to the timetable. When calculating the duration of the meeting, we must think about setting aside time for requests and questions that can be asked at the end of the meeting.

- The space where the meeting is held, in the case of face-to-face meetings, must be adequate for the number of people convened, and must have all the technological and analogue tools necessary to clearly set out all the issues to be discussed.

- Once in the meeting, we have to assign the “role” that each of the attendees has to assume, if the interventions have to be marked. What is clear is that there must be a moderator, who will usually be the convenor, to avoid diluting the objective for which we are meeting.

- For a correct development, before starting, the moderator must read the agenda in order to be clear about the issues to be discussed or resolved, and make clear the reason for the meeting. From this point onwards, he or she must ensure that the time allocated to each of the topics and speakers is respected, so that the established timetable is adhered to and everyone can make their points.

- Once all the scheduled interventions have been completed, it is time for Q&A, in order to polish the topics dealt with, resolve any doubts that may have arisen, and decide whether any new contributions should be made before ending the session.

- In the closing session, it is important to define the conclusions drawn, as well as the solutions to the problems that have arisen during the meeting, and the deadlines for carrying out the actions to be undertaken.

- Finally, it is important to draw up a summary or a record of the minutes that includes everything that has been presented, interventions, conclusions, and even details the decisions that have been taken and the actions that must be carried out from now on.

The achievement of all these premises should guarantee effective and efficient internal meetings, meetings with suppliers and meetings with clients, so that we do not end up with a feeling of wasted time. It is especially important to make the most of time in order to achieve productivity and efficiency objectives that generate the economic benefits necessary for the survival of an organisation, thus guaranteeing the professional and personal stability of all those involved.

Do you want to be the first to receive the latest news about 11Onze? Click here to subscribe to our Telegram channel

La pujada generalitzada de preus està complicant les finances de moltes llars. Cada vegada és més difícil quadrar els comptes per a arribar a final de mes i encara més dedicar una part dels nostres ingressos a l’estalvi. Davant aquesta situació, recollim onze consells per a millorar l’economia familiar.

- Aplicar la fòrmula del 50/30/20. Es tracta d’intentar distribuir els nostres ingressos de forma que el 50 % es dediqui a les despeses (llum, aigua, lloguer, hipoteca, telèfon, menjar, estudis…), el 30 % al nostre oci (les nostres sortides en esmorzars o dinars fora de casa, vacances, regals…) i el 20% restant a l’estalvi.

- Retallar subscripcions innecessàries. A quantes plataformes digitals estem subscrits? Les fem servir totes? Cal que les continuem pagant? I aquella subscripció a aquella revista que mai acabem llegint? Totes les subscripcions automàtiques s’han de revisar per valorar si són necessàries. Avui en dia existeixen diferents plataformes amb contingut en línia que són legals i gratuïtes, només cal fer una ullada per Internet per trobar-les. I recordem que les biblioteques també són una gran font de llibres i contingut audiovisual.

- Revisar els nostres contractes de llum, gas i telèfon. Cal revisar amb molta cura els contractes que tenim amb les diferents companyies de serveis. És una de les partides on més diners se’ns en van sense adonar-nos al cap de l’any. No podem prescindir d’aquestes despeses, però sí reduir-les.

- Fer més àpats a casa. Reduir les vegades que sortim a menjar fora de casa o que comprem menjar per emportar-nos pot arribar a ser una molt bona font d’estalvi. No cal deixar d’anar als restaurants, però sí reduir la quantitat d’àpats que fem fora de casa, i més si som una casa de família nombrosa.

- Reutilitzar. Quan una cosa se’ns faci malbé, mirem si podem reparar-la i allargar-ne la vida abans de llençar-la a les escombraries. També és una bona eina d’estalvi comprar roba de segona mà, llibres, mobles i fins i tot electrodomèstics.

- No comprar impulsivament. Una de les raons principals per les quals no fem un bon ús dels nostres diners són les compres compulsives. A partir d’ara, quan vulguem una cosa, donem-nos un marge de temps per saber si de veritat la necessitem. Ens sorprendrà comprovar que podem prescindir de gran part de les coses que volem comprar a cop de targeta.

- Comparar preus. Quantes vegades ens ha passat que comprem un telèfon mòbil, per dir un exemple, i l’endemà veiem una oferta del mateix producte en una altra botiga? Això ens passa per no comparar. Hem d’aprendre a comparar tot el que comprem, fins i tot el menjar.

- Fer servir menys el cotxe. Tot i que molta gent no pot prescindir del transport privat, sí que en podem reduir l’ús. Mirem d’utilitzar el transport públic o compartir cotxe si és possible. I fem ús també de la bicicleta, i sobretot, de les nostres cames, que caminar és sa i gratuït.

- Escollir una bona entitat financera. Són necessàries totes les nostres targetes de crèdit? Quines comissions ens cobra la nostra entitat financera? Revisem si aquesta entitat financera ens ajuda a tenir una bona economia personal, o si, per contra, cal que fem un canvi. Actualment, hi ha moltes entitats financeres amb eines que ajuden a controlar les teves despeses i que alhora et donen un cop de mà per estalviar: escollim una bona entitat financera pel nostre futur.

- Adaptar-nos a la nostra butxaca. Si ingressem una certa quantitat de diners, no fem més del que la nostra economia es pot permetre. No cal “estirar més el braç que la màniga”, com diem els catalans. Fem un ús responsable dels nostres diners segons els nostres guanys.

- Ser previsors. Hem d’analitzar l’evolució de les nostres despeses en els últims mesos per comprovar en què se’ns va els diners i on podem retallar. Davant l’actual situació inflacionària, en alguns casos serà necessari aplicar una “economia de guerra” segons com estimem que evolucionaran els nostres ingressos i despeses.

- Ja fa dies que sabem que els diners no fan la felicita. Però podem aportar estabilitat a la nostra economia personal per evitar-nos disgustos. A més, en aquests temps d’incerteses econòmiques, val la pena recordar la frase que ens va deixar el filòsof Sèneca: “No és pobre qui té poc, sinó qui molt desitja”.

Si vols descobrir la millor opció per protegir els teus estalvis, entra a Preciosos 11Onze. T’ajudarem a comprar al millor preu el valor refugi per excel·lència: l’or físic.